HAVE QUESTIONS?

Frequently Asked Questions

Q: What is credit repair?

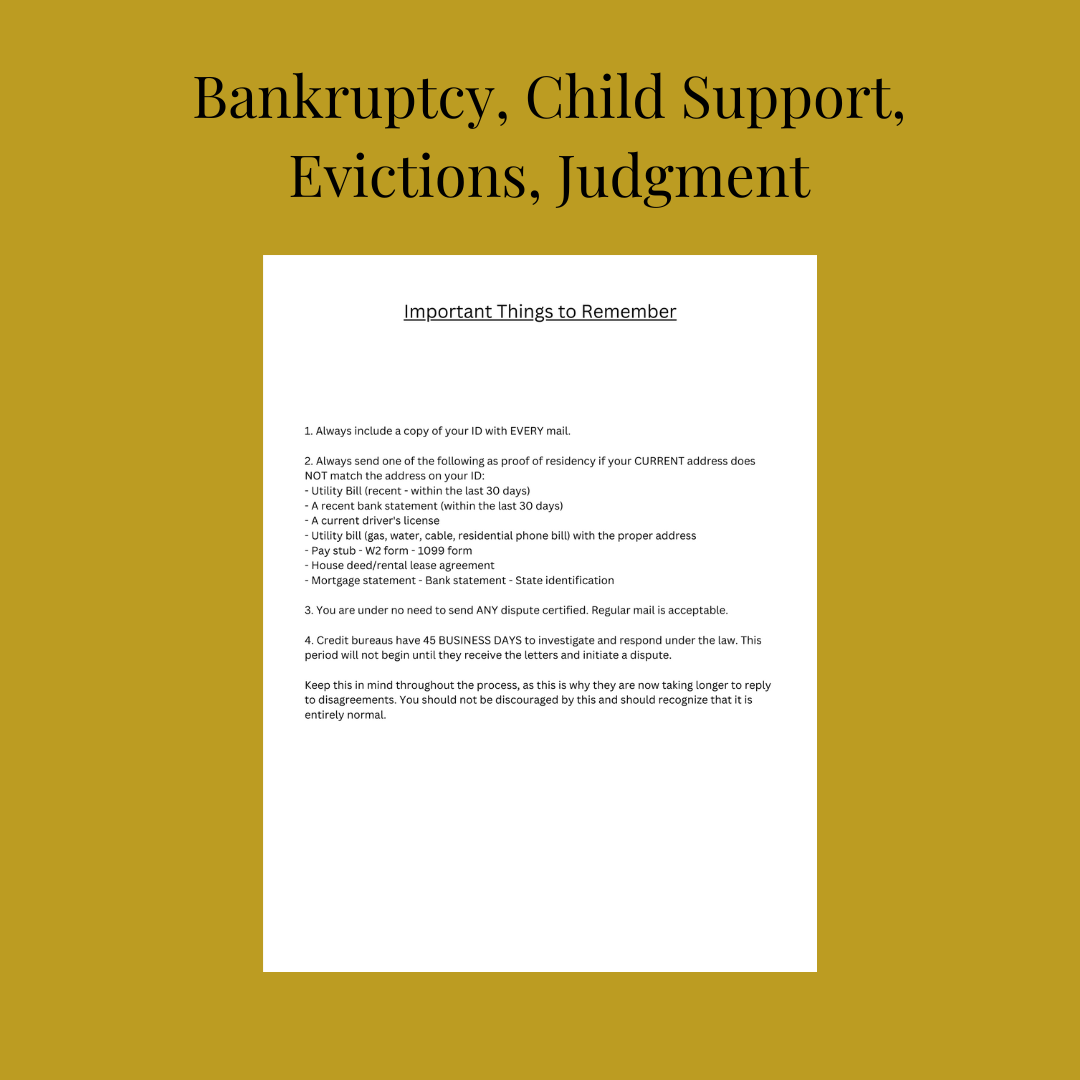

A: Credit repair refers to the process of improving an individual's creditworthiness by addressing and resolving negative items on their credit report. This may involve disputing inaccurate information, negotiating with creditors, and implementing strategies to rebuild credit.

Q: How long does credit repair take?

A: The duration of credit repair can vary depending on the complexity of the individual's credit situation. It may take several months to a year or more to see significant improvements. Patience and consistent effort are key during the credit repair process.

Q: Can credit repair guarantee a specific credit score increase?

A: No, credit repair companies cannot guarantee a specific credit score increase. The effectiveness of credit repair depends on various factors, including the accuracy of the information being disputed and the individual's overall credit history. However, credit repair can help address negative items and improve creditworthiness over time.

Q: Is credit repair legal?

A: Yes, credit repair is legal. The Fair Credit Reporting Act (FCRA) grants consumers the right to dispute inaccurate or incomplete information on their credit reports. Credit repair companies operate within the boundaries of these laws and regulations.

Q: Can I repair my credit on my own?

A: Yes, individuals can attempt to repair their credit on their own. However, it can be a complex and time-consuming process. Credit repair companies have experience and expertise in dealing with credit bureaus, creditors, and the dispute process, which can often streamline the credit repair journey.